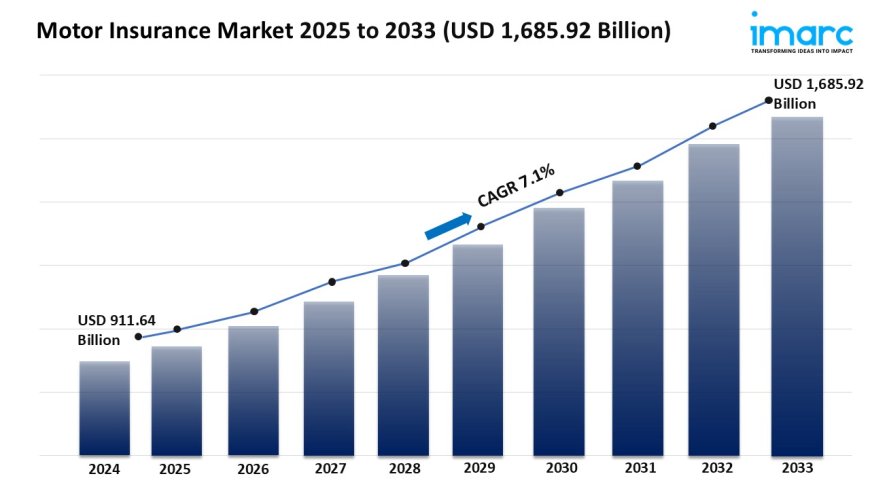

Motor Insurance Industry Growth, Share & Forecast 2025-2033

The global motor insurance market size was valued at USD 911.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,685.92 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033.

Market Overview:

The motor insurance market is experiencing rapid growth, driven by rising vehicle ownership and urbanization, advancements in telematics technology, and stringent regulatory mandates. According to IMARC Groups latest research publication, Motor Insurance Market Size, Share, Trends and Forecast by Policy Type, Premium Type, Distribution Channel, and Region, 2025-2033, the global motor insurance market size was valued at USD 911.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,685.92 Billion by 2033, exhibiting a CAGR of 7.1% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/motor-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Motor Insurance Market

- Rising Vehicle Ownership and Urbanization

The motor insurance industry is booming because more people are buying cars, especially in fast-growing cities across emerging markets. As urban areas expand, vehicle numbers are soaring, driving demand for insurance to cover accidents, theft, and liabilities. For example, in India, vehicle sales have surged due to a growing middle class, with millions of new cars hitting the roads yearly. This spike pushes insurers to offer tailored policies, boosting market growth. Government mandates, like Indias requirement for third-party liability coverage, ensure that every new vehicle owner needs insurance, further fueling the industry. Companies like Bajaj Allianz are capitalizing on this by offering affordable plans for urban drivers, making insurance a must-have for millions navigating crowded city streets.

- Advancements in Telematics Technology

Telematics is transforming the motor insurance industry by enabling insurers to track driving behavior and offer personalized premiums. Devices or apps collect data on speed, braking, and mileage, allowing companies to reward safe drivers with lower rates. For instance, Progressive Corporation has rolled out telematics-based policies in multiple markets, reporting a 20% increase in customer retention due to fair pricing. Governments are also supporting this tech; the EUs push for connected vehicle standards encourages telematics adoption. This data-driven approach not only attracts tech-savvy customers but also helps insurers reduce claim costs by identifying risky drivers early. As more people embrace smart vehicles, telematics is becoming a game-changer, making the motor insurance industry more competitive and customer-focused.

- Stringent Regulatory Mandates

Governments worldwide are tightening rules, making motor insurance a legal necessity and driving industry growth. In many countries, like the UK and India, third-party liability insurance is mandatory for all vehicles, ensuring a steady customer base. For example, the UKs motor insurance market is valued at 26.9 billion, largely due to strict laws requiring coverage for accidents and theft. Insurers like Zurich Insurance Group are adapting by offering flexible policies to meet these regulations while keeping premiums competitive. These mandates protect drivers and create a stable revenue stream for insurers. As governments introduce new road safety laws, the motor insurance industry grows by aligning with compliance needs, offering innovative products to meet legal standards.

Key Trends in the Motor Insurance Market

- Usage-Based Insurance (UBI) Gaining Traction

Usage-based insurance (UBI) is shaking up the motor insurance industry by tying premiums to actual driving habits. Using telematics, insurers like Progressive and Allianz offer policies where safe drivers pay less based on real-time data like mileage or braking patterns. For example, a US insurer reported 15% premium reductions for low-mileage drivers, attracting younger, cost-conscious customers. This trend is growing as urban drivers seek affordable options in high-traffic areas. UBI also benefits insurers by lowering claim risks through better driver profiling. As more people adopt connected cars, UBI is becoming a go-to choice, blending affordability with fairness in the motor insurance industry, and its reshaping how policies are priced and sold.

- Embedded Insurance at Point of Sale

Embedded insurance, where coverage is bundled with vehicle purchases, is a hot trend in the motor insurance industry. Dealerships and online platforms now offer instant insurance quotes during car sales, streamlining the process. For instance, in Asia-Pacific, over 35% of motor insurance policies are sold this way, driven by digital platforms like car-buying apps. Companies like Tokio Marine Group are partnering with automakers to embed policies, boosting convenience and sales. This trend cuts friction for buyers, who get coverage without extra steps. Its especially popular in markets like India, where digital adoption is high. By integrating insurance into the purchase experience, the motor insurance industry is tapping into new customer segments and boosting market reach.

- AI-Powered Personalization

Artificial intelligence is revolutionizing the motor insurance industry by offering hyper-personalized policies. AI analyzes data from customer interactions and driving patterns to tailor coverage and pricing. For example, Lemonade, a digital insurer, uses AI to process claims 30% faster than traditional methods, improving customer satisfaction. Insurers are also leveraging AI to predict risks, like accident likelihood, based on driving data, which helps set fairer premiums. This trend is gaining momentum as consumers demand seamless, customized experiences. In markets like Asia, AI-driven platforms are boosting policy sales by 10-15% annually. By making insurance feel personal and efficient, AI is driving growth and loyalty in the motor insurance industry.

We explore the factors propelling the motor insurance market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Motor Insurance Industry:

- American International Group Inc.

- Assicurazioni Generali S.p.A.

- AXA Cooperative Insurance Company (Gulf Insurance Company K.S.C.)

- Bajaj Allianz General Insurance Company Limited

- China Ping An Insurance Co. Ltd.

- Government Employees Insurance Company (Berkshire Hathaway Inc.)

- Reliance General Insurance Company Limited (Reliance Capital Limited )

- State Farm Mutual Automobile Insurance Company

- The Hanover Insurance Group Inc. (Opus Investment Management)

- The Progressive Corporation

- Universal Sompo General Insurance Company Limited

- Zurich Insurance Group Ltd.

Motor Insurance Market Report Segmentation:

By Policy Type:

- Liability Insurance

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

Liability insurance is the largest component in 2024 due to its mandatory nature, protecting individuals and businesses from financial losses caused by accidents and increasing demand from rising vehicle ownership.

By Premium Type:

- Personal Insurance Premiums

- Commercial Insurance Premiums

Personal insurance premiums vary based on risks associated with individual car owners, while commercial insurance premiums are generally higher due to the increased risk and specialized coverage needed for vehicle fleets.

By Distribution Channel:

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

In 2024, insurance agents/brokers dominate the market by providing personalized services and expert advice, helping clients navigate complex policy options, despite the growing popularity of digital platforms.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

In 2024, North America holds the largest market share due to its established infrastructure, high vehicle ownership rates, and mature insurance sector, with strong demand driven by mandatory liability coverage and technological advancements.

Research Methodology:

The report employs acomprehensive research methodology, combiningprimary and secondary data sourcesto validate findings. It includesmarket assessments, surveys, expert opinions, and data triangulation techniquesto ensureaccuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145